Archive for the ‘Pound’ Category

Wednesday, July 6th, 2016

The pound tumbled to a new 31-year low on Wednesday (July 6), at one point dipping below $1.28, on fears over the effect of last month’s Brexit vote on Britain’s property market and the prospect of cuts in Bank of England interest rates.

The pound, one of the main vehicles through which financial markets can express concern about Britain’s decision to leave the European Union, fell as low as $1.2798 in Asian trading, its lowest since June 1985. It recovered to about $1.2891 in afternoon trading in London.

That still left it more than 13 per cent weaker than it was before the June 23 referendum, and about 1 per cent lower on the day.

(more…)

Tags: Brexit, eu, Euro, pound sterling, UK, usd

Published in Currencies, Dollar, Euro, GBP, News, Political, Pound, Uncategorized, trading, usd | No Comments »

Tuesday, June 21st, 2016

With the Brexit vote taking place in less than 48 hours, many Forex online traders (Foreign Exchange Market) are sweating at their palms. Numerous, who are trading, had said that the markets were looking incredibly risky. Investors have been closely been following the vote. The vote will take place on Thursday. According to recent polls, the vote is set to be substantially close.

(more…)

Tags: Brexit, england, EUR/GBP, European Union, GBP, UK

Published in Euro, GBP, Political, Pound | No Comments »

Monday, June 2nd, 2014

The two days gains shown by the Pound have been halted, as figures show that mortgage approval rates dipped to their lowest rate in nine months during April.

The two days gains shown by the Pound have been halted, as figures show that mortgage approval rates dipped to their lowest rate in nine months during April.

The approval rate dropped as a result of the tightening of lending rules used by the banks.

Banks have been tightening the rules that they apply to mortgage lenders for several months.

In April, new rules demand that borrowers show they will be able to afford repayments even if the interest rate rises.

While the decline in mortgages has hit the Pound’s ascent, it may have helped to quell fears surrounding the property market.

Officials were set to meet to discuss what actions, if any, needed to be taken to prevent the property growth from becoming more of a problem.

(more…)

Tags: england, mortgage

Published in GBP, Pound, trading | No Comments »

Wednesday, April 24th, 2013

Online forex trading investors will no doubt have been relieved by the stock market’s positive start to 2013 but now fears of a triple-dip recession in the UK could risk reversing the gains made and force the market back into a nose dive.

Online forex trading investors will no doubt have been relieved by the stock market’s positive start to 2013 but now fears of a triple-dip recession in the UK could risk reversing the gains made and force the market back into a nose dive.

On the back of recent uncertainty in the Eurozone caused by the Cyprus bailout and growing fears of economic catastrophe in Slovenia, the UK’s continual teetering on the brink of recession is causing concern among traders and recent gains on the stock market have already begun to fall away.

(more…)

Tags: cyprus, FTSE 100, Office for National Statistics, slovenia, triple-dip recession, United Kingdom

Published in GBP, News, Pound | No Comments »

Wednesday, March 6th, 2013

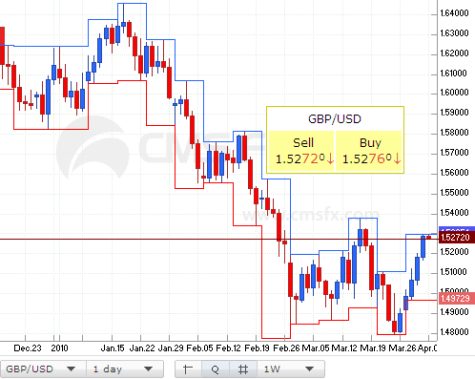

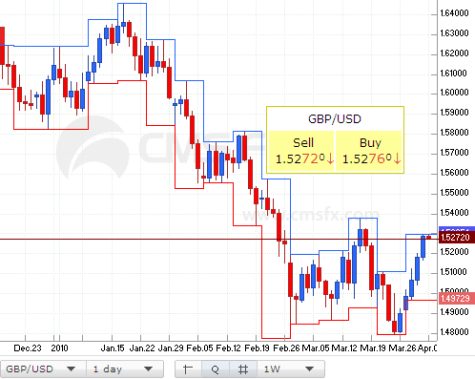

The pound seems to be on a free-fall, having fallen by more than 7 per cent against the dollar, in the last two months.

The pound seems to be on a free-fall, having fallen by more than 7 per cent against the dollar, in the last two months.

Yesterday, the pound fell by about two cents in forex trading, or 100 points, to touch $1.4993, before rebounding to $1.5019, in later trade.

This is the first instance, in two and a half years, of the sterling trading below the symbolic $1.50 mark.

(more…)

Tags: Purchasing Managers Index, uk pmi

Published in GBP, News, Pound, usd | No Comments »

Monday, July 11th, 2011

After losing ground for 13 months in a row, USD is about to break out and gain momentum against both euro (EUR) and sterling pound (GBP), according to technical analysts.

Why is USD gaining ground?

Many European countries economy is weak, with Portugal getting downgraded by Moody’s and Greece are having big problems paying their debt. Italian stock market fell almost 9 % previous week over yield spread concerns.

In fear of rising inflation, ECB increased the interest rates last week, without any positive effect on the exchange rates.

Both USA and British economies remains week, but not as bad as the Eurozone.

What do you think about EUR, GBP and USD? Will USD gain significant against sterling and the single currency?

Tags: greece

Published in Currencies, Euro, Pound, usd | 1 Comment »

Thursday, August 19th, 2010

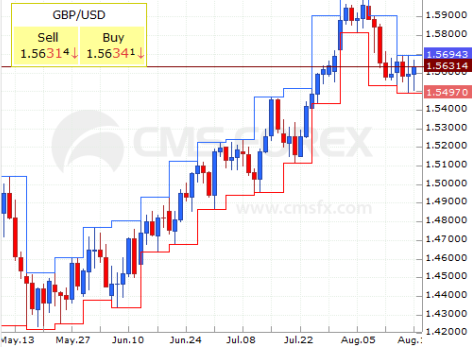

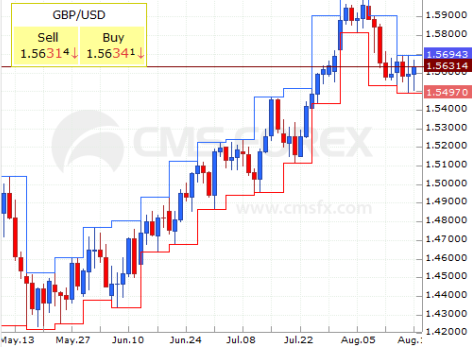

Sterling Pound against US Dollar is now in an up-trend after bottoming at 1.4425. How long will it continue? Let us look at the latest currency graph for GBP/USD.

Current intraday support levels are at 1.5589 and 1.5710, while weekly resistance levels are at 1.6460 and 1.70. It’s no secret that many analysts expect Sterling to rise against the dollar. If the US economy continue to show poor statistics, we believe GBP will rise sooner rather then later.

What do you think about the latest strength for GBP? Will it continue or break down?

Tags: Dollar, GBP, GBP/USD, Pound, pound sterling, us dollar, usd

Published in Dollar, Pound | 1 Comment »

Wednesday, August 11th, 2010

After reaching 6 month high last week, pound sterling is now falling to it’s lowest lever in more than a week. Reason: Data signals Britain is not recovering as quick as expected.

Housing market slows down

The first decline in property prices appeared in July, showing a slower sales growth then previous months. Sterling fell to $1.5740 in London afternoon trading hours.

Analysts such as John Hydeskov, Danske Bank, believe Sterling is overbought and should have a correction. He suggest buying Norwegian krone instead..

Tags: Dollar, GBP/USD, Pound, pound sterling, usd

Published in NOK, Pound, usd | No Comments »

Tuesday, July 13th, 2010

The British pound also experienced increased resistance on Monday after the first quarter of UK economic data was worse than previously expected. There are many indications now that the recession been worse than expected and economic growth lower then earlier estimated.

UK inflation way over target level

The country’s inflation in recent months is now 3.7%, significantly above the Bank of Englands target level of 2%. Britain could be forced to raise interest rates relatively soon, as MPC member Andrew Sentance already voted for. But Mr. Archer at the Bank of England believes inflation is on a downward trend and believe rates will be kept at 0.5% throughout 2010 and well into in 2011. How credible is the new government and how well will they keep Britain’s a currency? If the BOE will not to curb inflation in the near future you can expect the British pound to decrease significantly.

When do you think Britain will raise interest rates?

Published in Inflation, Pound, Statistics | 1 Comment »

Tuesday, May 11th, 2010

After a few days of discussions, many observers believe Tories and Liberal Democrats are forming a coalition government in United Kingdom. Currency analysts are now relieved that Gordon Brown seems to step down as Labours leader from September this year.

The new government are likely to cut borrowing sooner then a Labour government would and in general, it should do well for the economy and the british currency. Forex analysts already predict a hung parliment between conservatives and liberal democrats and they seem to like it – pound sterling rose by almost 1 % today. Interest rates (more…)

Tags: conservatives, Dollar, english economy, GBP, GBP/USD, gordon brown, liberal democrats, pound sterling, tories, us dollar

Published in Interest rates, Political, Pound, usd | No Comments »

Tuesday, April 13th, 2010

A stronger demand then previous t-bill auctions, made the euro gain slightly against the main trading partners on Tuesday.

Government t-bill auction received $780 million euros

Today’s auction was attracting double as much capital as the last time. The treasure bills sold had a lenght of 26 weeks at a yield of 4.55 %. Greece also offered t-bills with a lenght of 52 weeks, with a yield of 4.85 %.

Euro rise against Dollar & Sterling Pound

It seems like euro forex traders were happy about the successful t-bill auction. During the afternoon, the Euro have risen considerable against several other currencies.

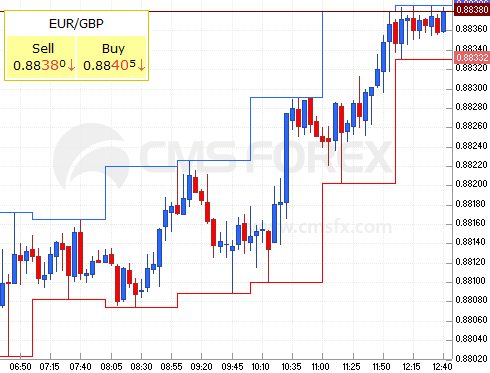

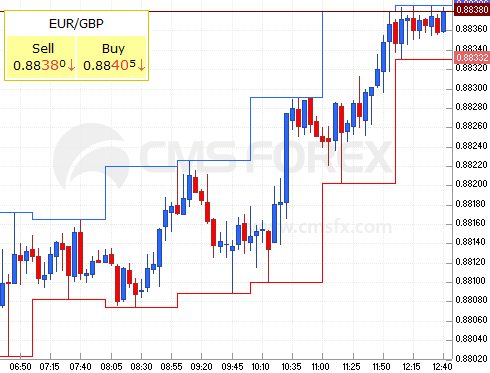

Against the Dollar (EUR/USD) from 1.3626 to 1.3573, and against the Pound Sterling (EUR/GBP) from 0.8808 to 0.8839.

euro - us dollar, 13th of April

Intraday graph, Euro against US Dollar above. (See more dollar graphs here)

euro - sterling, 13th of April

Intraday graph, Euro against Pound Sterling above. (See more Euro graphs here)

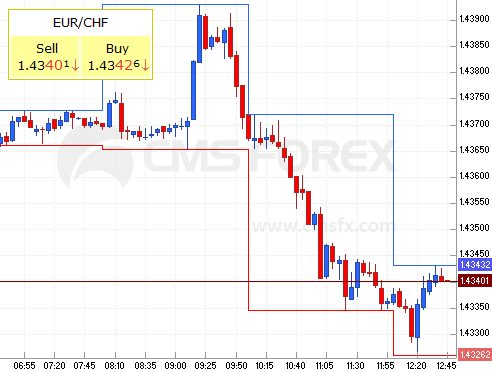

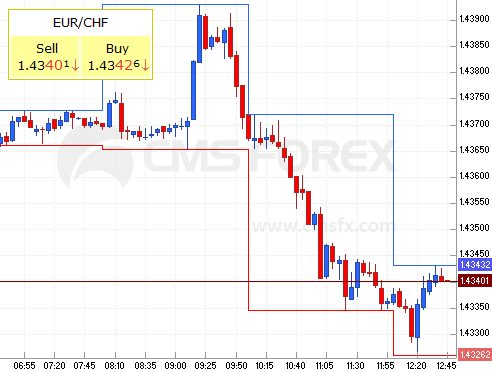

Finally, the Euro against the Swiss Franc (EUR/CHF) went from 1.4390 to 1.4334.

euro - franc, 13th of April

Intraday graph, Euro against Swiss Franc above.

Or why not check our some more Euro graphs.

Where do you think the Euro is heading in the coming weeks?

Tags: EUR, EUR/CHF, EUR/GBP, EUR/USD, Euro, euro rise, swiss franc, t-bills

Published in Dollar, Euro, Franc, Pound | No Comments »

Friday, April 2nd, 2010

The pound sterling has been declining during most of this year, but maybe we are about to see a turning point now?

As you can see in the GBP minute graph, the Pound Sterling have been increasing against US Dollar before Easter holidays starts.

In the longer forex charts for GBP/USD, it looks like the GBP (more…)

Tags: GBP, GBP/USD, Pound, pound sterling, us dollar, usd

Published in Pound, usd | No Comments »

Saturday, December 12th, 2009

The Dollar ended the week with monthly records against its major six rivals, indicating a broad strenght of the US currency.

Major investors and forex analysts expect that recent stronger economic data will prompt FED to higher interest rates sooner the earlier expected.

Stronger data supports the US dollar

The recent series of stronger data are shifting to support the dollar. “At least from an interest-rates perspective,” said Mike Moran, senior forex strategist at Standard Chartered Bank in New York. (more…)

Tags: Dollar, dollar surges, usd

Published in Dollar, Euro, Pound, usd | No Comments »