Posts Tagged ‘bank of england’

Tuesday, August 2nd, 2016

Speculators that are the most bearish on sterling in nearly 25 years may be vindicated by a report published on Monday (August 1) showing Brexit is probably hitting Britain harder than markets previously envisaged.

Speculators that are the most bearish on sterling in nearly 25 years may be vindicated by a report published on Monday (August 1) showing Brexit is probably hitting Britain harder than markets previously envisaged.

Sterling declined versus most of its 16 major peers as the data showed UK manufacturing shrank more than initially forecast in July.

Hedge funds and other large speculators ran the biggest net short positions, or bets on the currency’s decline, since records began amid speculation that the Bank of England will cut interest rates for the first time in more than seven years on Thursday, August 4 to head off the risk of recession.

(more…)

Tags: bank of england, BoE, Brexit, eu, EUR/GBP, GBP/USD, pound sterling

Published in Central Banks, Currencies, Dollar, Euro, GBP, News, Political, Uncategorized, usd | No Comments »

Tuesday, July 19th, 2016

The pound fell even as a report showed the UK’s annual inflation rate rose more in June than economists forecast.

The pound fell even as a report showed the UK’s annual inflation rate rose more in June than economists forecast.

Sterling weakened versus most of its 16 major peers. UK consumer prices climbed 0.5 per cent last month from a year earlier, the Office for National Statistics said in London. Analysts had expected the rate to rise to 0.4 per cent, from 0.3 per cent in May, according to the median estimate in a survey by news agency Bloomberg. The Bank of England’s 2 per cent inflation target was last reached in December 2013.

The Bank of England signalled last week it is readying stimulus for August as the economy reels from Britain’s decision to quit the European Union. Minutes of the BOE’s July meeting showed most members of the Monetary Policy Committee expect policy to be loosened next month.

(more…)

Tags: bank of england, Brexit, GBP, markets.com, pound sterling, UK

Published in Central Banks, Currencies, GBP, News, Political, Uncategorized | No Comments »

Wednesday, November 13th, 2013

An optimistic quarterly inflation report from the Bank of England on Wednesday saw Sterling surge on the Forex markets, with well-placed online traders taking good advantage of the announcement.

An optimistic quarterly inflation report from the Bank of England on Wednesday saw Sterling surge on the Forex markets, with well-placed online traders taking good advantage of the announcement.

The Bank’s Governor, Mark Carney, commented that economic recovery was taking hold in the UK and the Bank’s projections for growth were moving forward, with next year’s annual growth expected to reach 2.8%, up 0.3% from the projection made in August.

(more…)

Tags: bank of england, ECB, European Central Bank, Eurostat, pound sterling, unemployment

Published in Euro, GBP, Interest rates | No Comments »

Wednesday, October 17th, 2012

All eyes will be on the Eurozone this week as a welter of news upturns expectations in the run up to Thursday’s EU Summit in Brussels. Spain in particular is breathing a little easier today, following Moody’s decision not to downgrade its credit rating to ‘junk’ status.

All eyes will be on the Eurozone this week as a welter of news upturns expectations in the run up to Thursday’s EU Summit in Brussels. Spain in particular is breathing a little easier today, following Moody’s decision not to downgrade its credit rating to ‘junk’ status.

The country’s debt remains in the investment grade, though by the slimmest of margins. Moody’s reaffirmed their Baa3 rating with a negative outlook, citing progress on economic reforms and bank restructuring domestically, and continued ECB bond-buying for the Euro periphery.

(more…)

Tags: bank of england, Euro, germany, spain

Published in Euro | No Comments »

Wednesday, October 3rd, 2012

As Greece slips into an ever deepening recession with unrest and protests reported across the country, the fate of the Europ hangs by a thread. With increasing risk of a Greek default, the Euro may slip against the dollar from its current high of 1.298/dollar.

As Greece slips into an ever deepening recession with unrest and protests reported across the country, the fate of the Europ hangs by a thread. With increasing risk of a Greek default, the Euro may slip against the dollar from its current high of 1.298/dollar.

Euro against dollar

After a brief rally that surged the Euro to 1.298 against the dollar, the looming threat of an European recession spurred by failing austerity measures in Greece and Spain has once again triggered a downward spiral of the Euro against the dollar. The coming few weeks will be crucial for forex traders are (more…)

Tags: bank of england, ECB, European Central Bank

Published in Euro, GBP | No Comments »

Tuesday, July 3rd, 2012

Recent Forex trading news highlights the continued fragile state of both the European and United States economies. Nonetheless, the US dollar varied in narrow ranges as liquidity tightens ahead of the July 4th bank holiday in America.

Recent Forex trading news highlights the continued fragile state of both the European and United States economies. Nonetheless, the US dollar varied in narrow ranges as liquidity tightens ahead of the July 4th bank holiday in America.

Eurozone PMI

Across the Atlantic in Europe, many online traders are eager to hear what the ECB and the Bank of England will state in their monthly policy announcements. Most traders foresee additional easing on (more…)

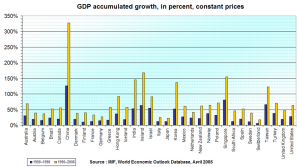

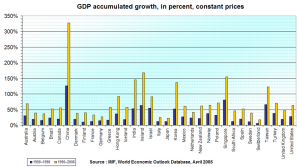

Tags: bank of england, BoE, eurozone pmi, eurozone solvency, gdp growth

Published in Euro, News, usd | No Comments »

Speculators that are the most bearish on sterling in nearly 25 years may be vindicated by a report published on Monday (August 1) showing Brexit is probably hitting Britain harder than markets previously envisaged.

Speculators that are the most bearish on sterling in nearly 25 years may be vindicated by a report published on Monday (August 1) showing Brexit is probably hitting Britain harder than markets previously envisaged.

The pound fell even as a report showed the UK’s annual inflation rate rose more in June than economists forecast.

The pound fell even as a report showed the UK’s annual inflation rate rose more in June than economists forecast.