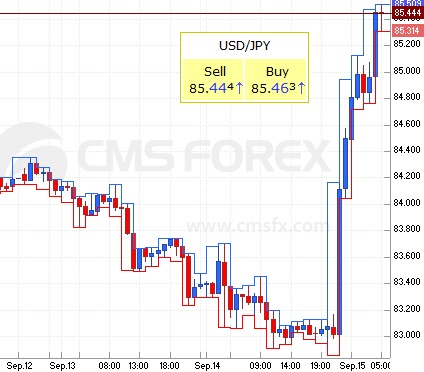

Yen strongly decreases in value after intervention

As we previously predicted it became inevitable for Bank of Japan (BOJ) to hold back its plans for intervention. JPY/USD went from 83 yen per dollar to 85.47 shortly after the intervention.

Strong yen – harmful for Japanese economy says Noda

Early this morning (9:30 ET) Yen reached a new 15-year high. This time, Bank of Japan was quick to intervene in the currency markets, selling yen in exchange for us dollars, after a week of possible intervention warnings. This intervention was made to counter the adverse impact of the strong yen, and was the first official intervention in the currency market since 2004.

“We conducted the intervention in order to avoid excessive movement in the currency market. The Bank of Japan will continue to watch market developments closely and we will take bold steps, including additional measures if necessary”, says Japan’s Finance Minister Yoshihiko.

He concludes:

“We can not ignore the fact that these movements could have a negative impact on the stability of the Japanese economy and financial markets”.

What happens to the japanese yen now?

There is no doubt that interventions in the major currency pairs are relatively rare. Many major investors are scared and more cautious to buy yen at the moment, since Bank of Japan are prepared to change the direction of the yen for any price.

It is probably not a great opportunity right now to go in and buy yen, while seing continued pressure on the Yen against the USD again. To keep track of the market, you can follow the latest developments through our live Yen currency graphs.

What do you think about the direction of the Yen? Will Japan’s currency weakened further after the Bank of Japan intervention, or is it on the way to new

record levels?