A stronger demand then previous t-bill auctions, made the euro gain slightly against the main trading partners on Tuesday.

Government t-bill auction received $780 million euros

Today’s auction was attracting double as much capital as the last time. The treasure bills sold had a lenght of 26 weeks at a yield of 4.55 %. Greece also offered t-bills with a lenght of 52 weeks, with a yield of 4.85 %.

Euro rise against Dollar & Sterling Pound

It seems like euro forex traders were happy about the successful t-bill auction. During the afternoon, the Euro have risen considerable against several other currencies.

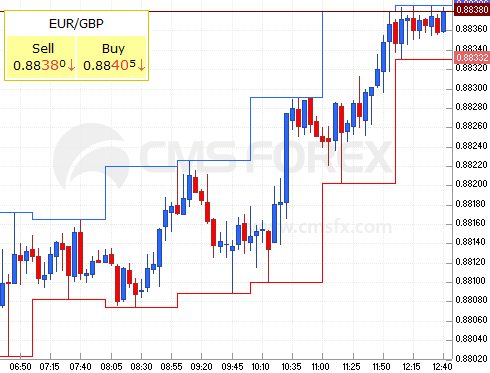

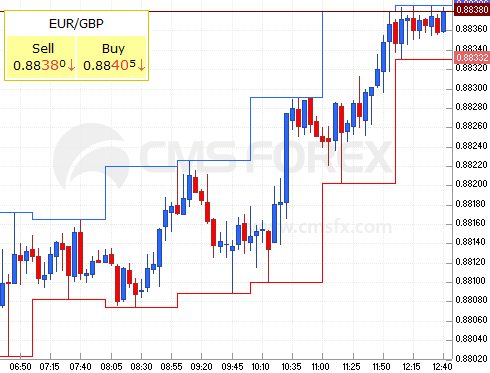

Against the Dollar (EUR/USD) from 1.3626 to 1.3573, and against the Pound Sterling (EUR/GBP) from 0.8808 to 0.8839.

euro - us dollar, 13th of April

Intraday graph, Euro against US Dollar above. (See more dollar graphs here)

euro - sterling, 13th of April

Intraday graph, Euro against Pound Sterling above. (See more Euro graphs here)

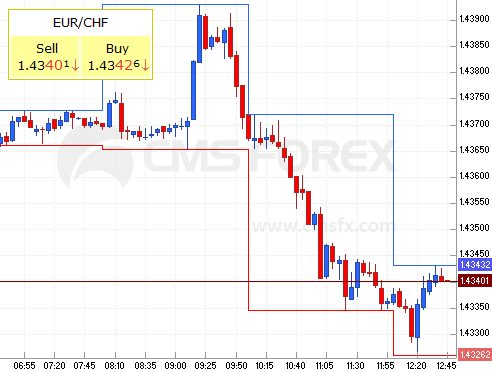

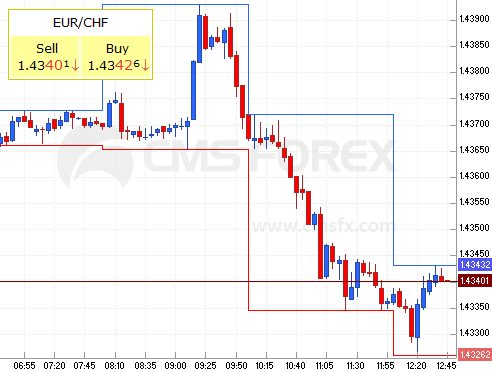

Finally, the Euro against the Swiss Franc (EUR/CHF) went from 1.4390 to 1.4334.

euro - franc, 13th of April

Intraday graph, Euro against Swiss Franc above.

Or why not check our some more Euro graphs.

Where do you think the Euro is heading in the coming weeks?