Posts Tagged ‘Dollar’

Wednesday, May 25th, 2016

The dollar climbed to a two-month high against the euro as traders boosted wagers that U.S. interest rates will rise, starting as early as next month.

The greenback strengthened versus most of its major peers after Federal Reserve Bank of Philadelphia President Patrick Harker said on Monday, May 23 that he could see two to three rate increases this year, echoing remarks by the San Francisco Fed Bank’s John Williams.

Futures are indicating for the first time since March a better-than 50 percent chance that the Federal Open Market Committee will raise rates by its July meeting.

(more…)

Tags: Dollar, European Central Bank, Federal Open Market Committee, Federal Reserve Bank of Philadelphia, The Bloomberg Dollar Spot Index, U.S., usd

Published in Currencies, Dollar, Euro, News, Uncategorized, trading, usd | No Comments »

Wednesday, May 4th, 2016

Less than two months after Goldman Sachs Group Inc. softened its short-term euro forecast after a central-bank policy meeting, the bank is doing the same with the yen.

Japan’s currency is likely to strengthen until Bank of Japan Governor Haruhiko Kuroda rolls out or signals additional stimulus measures, analysts led by Robin Brooks, the bank’s chief currency strategist, wrote in a note to clients on Monday.

(more…)

Tags: bank of japan, Dollar, Euro, euro Goldman Sachs, usd, Yen

Published in Currencies, Dollar, Euro, News, Uncategorized, Yen, trading, usd | No Comments »

Thursday, August 23rd, 2012

In the latest forex news, the US dollar has slid considerably in comparison to other major currencies.

In the latest forex news, the US dollar has slid considerably in comparison to other major currencies.

While earlier this month many forecasts were bullish regarding the dollar’s upward trend, analysts have now scaled off this position and are taking a more contemplative approach.

Indeed, the dollar may slide further as is possibly indicated by the relative strength index (RSI) which appears to be setting the stage for a downward trend in the weeks to come. This is especially relevant considering that the Jackson Hole Economic Symposium is on schedule for the following week.

Although the bearish stance for the dollar may continue temporarily, should chairman Bernanke not hint at another round of QE3, sentiments may begin to reverse.

(more…)

Tags: Dollar, EUR, EUR/USD, Euro, outlook, United States, us dollar, USA, usd

Published in Currencies, Dollar, Euro, usd | 1 Comment »

Monday, August 13th, 2012

Hosting the 2012 Olympic Games cost the British government an estimated £9.3 billion. While this may seem like an exorbitant amount, history has shown that hosting the Olympics can not only be a matter of prestige for a city, but also stimulate local economies and boost tourism, thus providing long term economic benefits.

Hosting the 2012 Olympic Games cost the British government an estimated £9.3 billion. While this may seem like an exorbitant amount, history has shown that hosting the Olympics can not only be a matter of prestige for a city, but also stimulate local economies and boost tourism, thus providing long term economic benefits.

British Olympic medal’s impact on cash reserves

The 2012 London Olympics have provided much needed cash reserves to the beleaguered British economy, which announced earlier in July that GDP output fell by 0.7 percent in the second quarter of the year. The games have been very successful, thanks in part to the British team’s exceptional performance.

(more…)

Tags: 2012 London Olympics, Dollar, EUR/USD, london olympics

Published in Euro, GBP | No Comments »

Tuesday, August 7th, 2012

Dominating Forex trading news is the Euro’s continued decline versus the dollar. The new low of 1.229 has hit many traders and this trend is predicted to continue for some time. The faltering of the Euro is seen to have been partially caused by fresh Greek unemployment figures, this data now showing that the number of jobless youths in Greece has hit a record high.

Dominating Forex trading news is the Euro’s continued decline versus the dollar. The new low of 1.229 has hit many traders and this trend is predicted to continue for some time. The faltering of the Euro is seen to have been partially caused by fresh Greek unemployment figures, this data now showing that the number of jobless youths in Greece has hit a record high.

(more…)

Tags: bonds, Dollar, ECB, EUR/USD, European Central Bank, italy, portugal, spain

Published in Dollar, Euro, GBP, usd | No Comments »

Monday, June 25th, 2012

This past week has seen a number of financially important events; from Greek election results to Spanish bonds surpassing all-time highs. Any signals of enthusiasm regarding Greece’s elections quickly faded and the overall value of the Euro has continued on a downward trend. The forex bears still seem firmly in place in both European and international market trading.

This past week has seen a number of financially important events; from Greek election results to Spanish bonds surpassing all-time highs. Any signals of enthusiasm regarding Greece’s elections quickly faded and the overall value of the Euro has continued on a downward trend. The forex bears still seem firmly in place in both European and international market trading.

While the immediate threat of an imminent Greek default being averted initially caused a slight rally in European markets, a broader analysis revealed investors’ sentiment still remains shaky; (more…)

Tags: Dollar, EUR/USD, Euro, online forex trading, spanish bonds, trading signals

Published in Dollar, Euro, News | 1 Comment »

Sunday, March 4th, 2012

Weakened Euro continues

The recent financial turmoil for the Euro continues. Despite extensive funding programs from the European Central Bank, which was presented on March 1st, the EUR currency fell further against both the Japanese Yen (JPY) and the American Dollar (USD).

A lot of efforts

The efforts to curb the crisis in the Euro-area is (more…)

Tags: Dollar, eu, Euro, Yen

Published in Currencies, Dollar, Euro, News, Yen, usd | No Comments »

Wednesday, September 15th, 2010

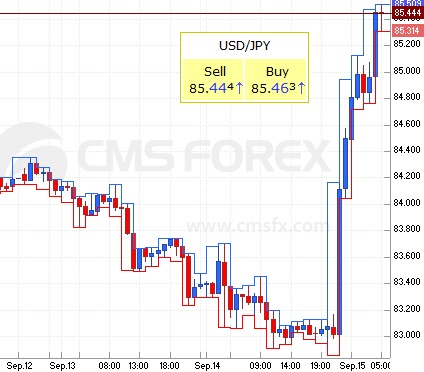

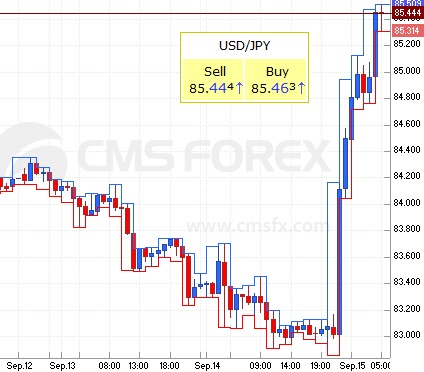

As we previously predicted it became inevitable for Bank of Japan (BOJ) to hold back its plans for intervention. JPY/USD went from 83 yen per dollar to 85.47 shortly after the intervention.

Strong yen – harmful for Japanese economy says Noda

Early this morning (9:30 ET) Yen reached a new 15-year high. This time, Bank of Japan was quick to intervene in the currency markets, selling yen in exchange for us dollars, after a week of possible intervention warnings. This intervention was made to counter the adverse impact of the strong yen, and was the first official intervention in the currency market since 2004.

“We conducted the intervention in order to avoid excessive movement in the currency market. The Bank of Japan will continue to (more…)

Tags: bank of japan, central bank interventions, Dollar, japanese currency, us dollar, USD/JPY, Yen, yen dollar

Published in Central Banks, Yen, usd | No Comments »

Saturday, September 4th, 2010

The yen surged to 15-year low on Friday against the dollar as fading confidence for the global economy have risen demand for the Japanese currency.

Will Bank of Japan intervene?

The latest move raised currency speculation of the Japanese central bank intervening in the forex market, which is rather uncommon (more…)

Tags: bank of japan, Dollar, us dollar, USD/JPY, Yen, yen dollar

Published in Carry Trading, Central Banks, Yen, usd | 1 Comment »

Wednesday, August 25th, 2010

The outlook for US Dollar have been going down, down and down against the Yen. Is it time for a turn-around soon?

New Economic Slowdown?

After the latest key U.S economic data was released, investors was first seriously concerned about the US economy showing, when July showed 27 % slowdown of previously owned U.S homes. But later, many forex investors insted became worried about the world economy instead and dollar started to rise again against many major currencies.

At the same time, Nikkei 225 rose to a 15-month low, while the Japanese currency become even stronger – 84 yen per USD. Yen is currently at its strongest value against USD this decade. Lets see how things move forward in the end of the week.

Tags: Dollar, japanese currency, us dollar, usd, Yen

Published in Data providers, Yen, usd | No Comments »

Thursday, August 19th, 2010

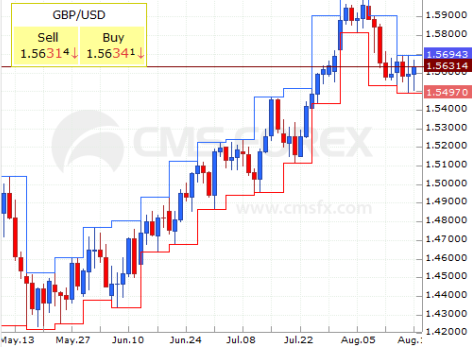

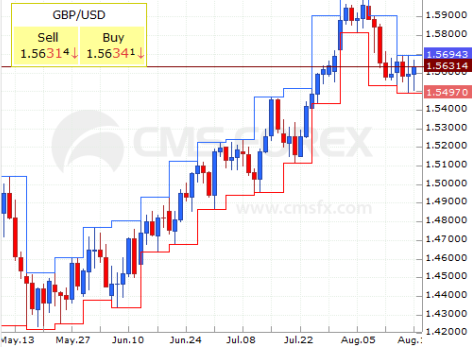

Sterling Pound against US Dollar is now in an up-trend after bottoming at 1.4425. How long will it continue? Let us look at the latest currency graph for GBP/USD.

Current intraday support levels are at 1.5589 and 1.5710, while weekly resistance levels are at 1.6460 and 1.70. It’s no secret that many analysts expect Sterling to rise against the dollar. If the US economy continue to show poor statistics, we believe GBP will rise sooner rather then later.

What do you think about the latest strength for GBP? Will it continue or break down?

Tags: Dollar, GBP, GBP/USD, Pound, pound sterling, us dollar, usd

Published in Dollar, Pound | 1 Comment »

Wednesday, August 11th, 2010

After reaching 6 month high last week, pound sterling is now falling to it’s lowest lever in more than a week. Reason: Data signals Britain is not recovering as quick as expected.

Housing market slows down

The first decline in property prices appeared in July, showing a slower sales growth then previous months. Sterling fell to $1.5740 in London afternoon trading hours.

Analysts such as John Hydeskov, Danske Bank, believe Sterling is overbought and should have a correction. He suggest buying Norwegian krone instead..

Tags: Dollar, GBP/USD, Pound, pound sterling, usd

Published in NOK, Pound, usd | No Comments »

Tuesday, May 11th, 2010

After a few days of discussions, many observers believe Tories and Liberal Democrats are forming a coalition government in United Kingdom. Currency analysts are now relieved that Gordon Brown seems to step down as Labours leader from September this year.

The new government are likely to cut borrowing sooner then a Labour government would and in general, it should do well for the economy and the british currency. Forex analysts already predict a hung parliment between conservatives and liberal democrats and they seem to like it – pound sterling rose by almost 1 % today. Interest rates (more…)

Tags: conservatives, Dollar, english economy, GBP, GBP/USD, gordon brown, liberal democrats, pound sterling, tories, us dollar

Published in Interest rates, Political, Pound, usd | No Comments »

Saturday, February 6th, 2010

Many European Investors believe the Euro crisis are about to spread to Spain and Portugal, after Greece took a hard hit in the beginning of the month. The Euro have taken a hard hit and lost over 6 % against the Euro the last weeks. Are Europe just in the beginning of the crisis, while US are on their way out?

Spain deny lost budget control

“We have control of the ship, we have a plan,” said María Teresa Fernández de la Vega, Spain’s deputy premier. Earlier the same day, the prime minister José Luis Rodríguez Zapatero, visited Washington

where he was confident about his home country: “Spain has a strong and solid financial system.”

Well, all are not as confident. Both Madrid and Lisbon ran up their budget deficits to dampen the effects of the economic crisis and partly because of (more…)

Tags: Dollar, Euro, usd

Published in Crisis, Dollar, Euro | No Comments »

Saturday, December 12th, 2009

The Dollar ended the week with monthly records against its major six rivals, indicating a broad strenght of the US currency.

Major investors and forex analysts expect that recent stronger economic data will prompt FED to higher interest rates sooner the earlier expected.

Stronger data supports the US dollar

The recent series of stronger data are shifting to support the dollar. “At least from an interest-rates perspective,” said Mike Moran, senior forex strategist at Standard Chartered Bank in New York. (more…)

Tags: Dollar, dollar surges, usd

Published in Dollar, Euro, Pound, usd | No Comments »

Friday, September 4th, 2009

Forex Traders are worried Fridays release of the US unemployment rate was way worse then expected and now the US Dollar might face further decrease.

American Labor Department reported that the much higher unemployment rate could be due to lagging data. The non-farm payroll employment fell by 216 000 jobs in August, followed by a revised decrease of 276 000 jobs in July. The new numbers are indication that America is now facing a 9.7 % unemployment rate, the highest in 26 years. Financial analysts and currency traders did expect a 9.4 % unemployment rate in July.

Further pressure on US Dollar

However, it seems like the decrease have moderated the last months, even if some sectors still face continued job losses. Still, consumer confident might be lagging in the coming months. As a result of the unexpected numbers from USA, many online forex traders assume that the US Dollar will continue to suffer against the Euro and Yen.

Tags: Dollar, unemployment rate, usd

Published in Dollar, Fx, Statistics | 1 Comment »

Tuesday, June 23rd, 2009

As the stock markets are starting to take a dip again, investors are moving away from smaller and riskier markets and currencies.

Swedish krona are having a hard time

One of the currencies that had a hard hit is the Swedish Krona, falling 1.35 % yesterday. It’s expected to fall from (more…)

Tags: Dollar, SEK, swedish krona, usd, USD/SEK

Published in Currencies, SEK | No Comments »