Archive for the ‘Yen’ Category

Thursday, August 18th, 2016

The yen strengthened beyond 100 per dollar for a second time this week as the U.S. currency’s bid to break out from a three-month low stalled after Federal Reserve minutes indicated officials were divided over the urgency to raise interest rates.

The yen strengthened beyond 100 per dollar for a second time this week as the U.S. currency’s bid to break out from a three-month low stalled after Federal Reserve minutes indicated officials were divided over the urgency to raise interest rates.

A gauge of the dollar has fallen more than 5 per cent this year as investors bet the Fed will raise interest rates at most once this year, compared with policy makers’ forecasts at the start of 2016 for four increases.

That means the U.S. central bank is less likely to diverge from the Bank of Japan and European Central Bank, which are boosting stimulus to spur flagging growth.

(more…)

Tags: bank of japan, central, Federal reserve, japanese yen, usd, USD/YEN

Published in Central Banks, Currencies, Dollar, News, Uncategorized, Yen, usd | No Comments »

Tuesday, July 26th, 2016

The yen rose more than 1 per cent against the dollar and the euro on Tuesday (July 26), as traders dialled back expectations of how much new stimulus Japanese authorities will inject into an ailing economy.

The yen rose more than 1 per cent against the dollar and the euro on Tuesday (July 26), as traders dialled back expectations of how much new stimulus Japanese authorities will inject into an ailing economy.

The Bank of Japan is expected to announce expanded asset purchases and a rate cut further into negative territory at the end of its policy meeting on Friday (July 29).

Meanwhile the government is compiling a spending package that some sources have estimated could be worth up to 20 trillion yen. But a Nikkei report on Tuesday (July 26) said direct fiscal stimulus into the economy would amount to about 6 trillion yen over the next few years.

(more…)

Tags: bank of japan, Euro, japanese currency, USD/YEN, Yen

Published in Central Banks, Currencies, Dollar, Euro, News, Yen | No Comments »

Wednesday, June 15th, 2016

With sterling trades seen too expensive, the yen and Swiss franc are in demand according to in-depth research by news agency Bloomberg.

The UK’s referendum on European Union membership is spurring volatility in the pound, making trading sterling increasingly expensive. Banks are pointing clients toward alternative currency bets or hedges that could fare well regardless of the outcome.

Here is a list of analysts’ favourite trades as written in research notes or recommended in interviews conducted by Bloomberg News in recent days.

(more…)

Tags: Brexit, currencies, eu, European Union, UK

Published in Central Banks, Currencies, Dollar, Euro, Forex Brokers, Franc, GBP, News, Political, Trade forex, Uncategorized, Yen, trading, usd | No Comments »

Wednesday, May 4th, 2016

Less than two months after Goldman Sachs Group Inc. softened its short-term euro forecast after a central-bank policy meeting, the bank is doing the same with the yen.

Japan’s currency is likely to strengthen until Bank of Japan Governor Haruhiko Kuroda rolls out or signals additional stimulus measures, analysts led by Robin Brooks, the bank’s chief currency strategist, wrote in a note to clients on Monday.

(more…)

Tags: bank of japan, Dollar, Euro, euro Goldman Sachs, usd, Yen

Published in Currencies, Dollar, Euro, News, Uncategorized, Yen, trading, usd | No Comments »

Tuesday, January 26th, 2016

Financial researchers have indicated that trading across all G10 currencies is similar to the type of trading conducted throughout recession periods. The G10 currencies are the most widely traded globally, these are:

US dollar (

USD)

Euro (

EUR)

Japanese yen (

JPY)

British pound (

GBP)

Australian dollar (

AUD)

Swiss franc (

CHF)

New Zealand dollar (NZD)

Swedish Krona (

SEK)

Canada dollar (

CAD)

Norway Krone (

NOK)

The researchers at NOMURA state fears of recession are not being stated at present, however, the current pattern of financial trading shows close links to the type of trading conducted during the recent financial crisis.

(more…)

Tags: crude oil, Federal reserve, G10 currencies, G3 currencies, NOMURA

Published in AUD, CAD, Currencies, GBP, Statistics, Trade forex, Yen, usd | No Comments »

Friday, July 24th, 2015

First Greece, then China, and now it is Japan that worries.

First Greece, then China, and now it is Japan that worries.

The International Monetary Fund, IMF is sensing out a warning regarding Japan’s debt in a completely new report. The IMF believes that Japan’s debt is unsustainable and that the risk of increasing as much as up to three times the country’s GDP (Gross Domestic Product) in 2030, is worrying. (more…)

Tags: japan crisis, japan debt crisis, japan politics

Published in Crisis, News, Political, Yen, survey | No Comments »

Sunday, August 31st, 2014

A good portion of the latest forex trading news has focused on the continued decline of the yen in comparison to its other major counterparts.

This benchmark currency took a battering when it emerged that investment policies in relation to the Government Pension Investment Fund (GPIF) will focus on more risky assets.

In turn, this has led some online Forex trading analysts to conclude that China feels as if the yen will continue its descent. Of course, a risk-averse strategy that reflected a bullish yen market would hardly employ such modifications.

(more…)

Tags: Government Pension Investment Fund, GPIF, Russia, Ukraine, yen dollar

Published in Political, Yen | No Comments »

Tuesday, June 18th, 2013

The online forex trading new on Monday saw the dollar managing to surpass the yen for the first time in five trading sessions, which is welcome news to a number of investors.

The online forex trading new on Monday saw the dollar managing to surpass the yen for the first time in five trading sessions, which is welcome news to a number of investors.

This relatively expected rise took place as there was a substantial gain in the manufacturing sector for the state of New York, which has generally seen favourable results in the month of June. Though we are still in the middle of the month, the trends show promise for future investors in the months to come.

(more…)

Tags: Federal reserve, USA, yen dollar

Published in News, Political, Yen, usd | No Comments »

Wednesday, June 12th, 2013

One of the dominating forex news stories centres around the relationship between the US dollar and the Japanese Yen. We have seen a rally, albeit perhaps briefly, against the dollar when online trading analysts learned that the Bank of Japan has not modified their domestic monetary policy as was moderately expected.

One of the dominating forex news stories centres around the relationship between the US dollar and the Japanese Yen. We have seen a rally, albeit perhaps briefly, against the dollar when online trading analysts learned that the Bank of Japan has not modified their domestic monetary policy as was moderately expected.

This decision was defended by the governor of the central bank when he stated that there is less volatility in the government bond markets than previously. This announcement led to the dollar declining 1.78 percent in comparison to the Yen during the American trading session on Tuesday. Some online traders and forex brokers believe that this leveraging of Japan’s currency and the resultant decline in equities may attract investment from abroad.

(more…)

Tags: bank of japan, Goldman Sachs, japanese currency, us dollar, USD/YEN, Yen

Published in AUD, Central Banks, Dollar, Yen | No Comments »

Wednesday, July 11th, 2012

Disappointing Chinese trade data saw Asian stocks declining and the US Dollar and Japanese Yen gain ground as traders turned to these safe haven currencies. The Chinese report showed that imports grew by only 6.3 percent in June, compared to May’s figures of 12.7 percent and the 11 percent analysts had forecasted. This is disappointing and places a question mark on Asian growth as many of the economies in the area rely on China as their main source of demand.

Disappointing Chinese trade data saw Asian stocks declining and the US Dollar and Japanese Yen gain ground as traders turned to these safe haven currencies. The Chinese report showed that imports grew by only 6.3 percent in June, compared to May’s figures of 12.7 percent and the 11 percent analysts had forecasted. This is disappointing and places a question mark on Asian growth as many of the economies in the area rely on China as their main source of demand.

Thus, overnight Forex tsraders saw the USD gain ground while the AUD (Australian Dollar) and NZD (New Zealand dollar) slipped. Clearly, many online traders opted to mitigate risk and buy up the greenback and Yen. (more…)

Tags: asian stocks, AUD/USD, Brussels, china, EUR/JPY, FOMC, japanese currency, NZD/USD

Published in Dollar, Euro, News, Political, Yen | No Comments »

Sunday, March 11th, 2012

The global currency markets accounts and balances are awaiting clearer prospects. This is due to the great concern of the now well-known Greek crisis. The crises has been temporarily mitigated by the cancellation of debts and new loans.

Greece in focus

In terms of international currencies, Greece is in focus. An agreement was signed on debts by private lenders and applies to investors holding government bonds. This has been possible since Greece decided (more…)

Tags: ECB, fukushima, greece, japanese currency

Published in Central Banks, Euro, Interest rates, Yen | No Comments »

Sunday, March 4th, 2012

Weakened Euro continues

The recent financial turmoil for the Euro continues. Despite extensive funding programs from the European Central Bank, which was presented on March 1st, the EUR currency fell further against both the Japanese Yen (JPY) and the American Dollar (USD).

A lot of efforts

The efforts to curb the crisis in the Euro-area is (more…)

Tags: Dollar, eu, Euro, Yen

Published in Currencies, Dollar, Euro, News, Yen, usd | No Comments »

Friday, March 25th, 2011

IMF recently told the press they fail to see any underlying fundamental factors giving the Yen any strength. According to International Monetary Fund, the current value of the Yen reflects long-term fundamentals. So basically, they mean that the Yen is still overvalued against USD and rest of the G7 countries.

Surprising G7 intervention against Yen

Last week, seven central banks from the G7 countries joined together in an effort to weaken the Yen. After the earthquake, the Japanese Yen has been traded stronger, in contrast to what you would expect.

Currency traders also claim that the Yen strengths is partly due to corporations, insurance firms and private people sending money back to Japan.

What do investors buy in Japan right now?

It seems like Japanese investors mainly focus on the (more…)

Tags: japanese currency, Yen, yen dollar

Published in Central Banks, Yen, usd | No Comments »

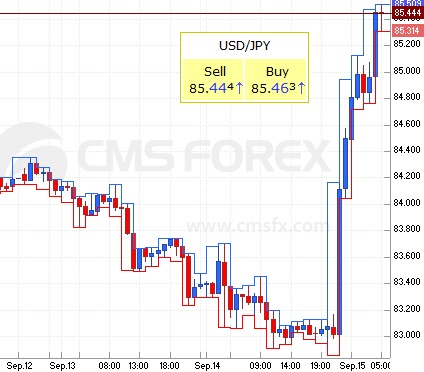

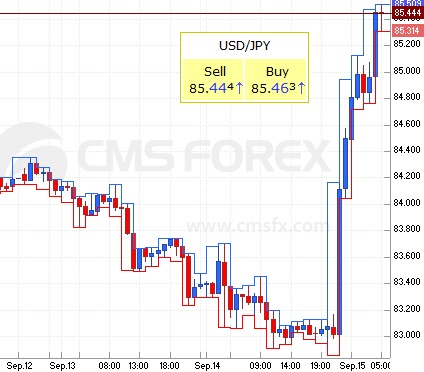

Wednesday, September 15th, 2010

As we previously predicted it became inevitable for Bank of Japan (BOJ) to hold back its plans for intervention. JPY/USD went from 83 yen per dollar to 85.47 shortly after the intervention.

Strong yen – harmful for Japanese economy says Noda

Early this morning (9:30 ET) Yen reached a new 15-year high. This time, Bank of Japan was quick to intervene in the currency markets, selling yen in exchange for us dollars, after a week of possible intervention warnings. This intervention was made to counter the adverse impact of the strong yen, and was the first official intervention in the currency market since 2004.

“We conducted the intervention in order to avoid excessive movement in the currency market. The Bank of Japan will continue to (more…)

Tags: bank of japan, central bank interventions, Dollar, japanese currency, us dollar, USD/JPY, Yen, yen dollar

Published in Central Banks, Yen, usd | No Comments »

Saturday, September 4th, 2010

The yen surged to 15-year low on Friday against the dollar as fading confidence for the global economy have risen demand for the Japanese currency.

Will Bank of Japan intervene?

The latest move raised currency speculation of the Japanese central bank intervening in the forex market, which is rather uncommon (more…)

Tags: bank of japan, Dollar, us dollar, USD/JPY, Yen, yen dollar

Published in Carry Trading, Central Banks, Yen, usd | 1 Comment »

Wednesday, August 25th, 2010

The outlook for US Dollar have been going down, down and down against the Yen. Is it time for a turn-around soon?

New Economic Slowdown?

After the latest key U.S economic data was released, investors was first seriously concerned about the US economy showing, when July showed 27 % slowdown of previously owned U.S homes. But later, many forex investors insted became worried about the world economy instead and dollar started to rise again against many major currencies.

At the same time, Nikkei 225 rose to a 15-month low, while the Japanese currency become even stronger – 84 yen per USD. Yen is currently at its strongest value against USD this decade. Lets see how things move forward in the end of the week.

Tags: Dollar, japanese currency, us dollar, usd, Yen

Published in Data providers, Yen, usd | No Comments »

Thursday, March 11th, 2010

Japanese currency are becoming more interesting for carry traders, while forex experts estimate a set-back over the next months.

Yen as a carry trade

During much of the beginning of the century, yen was the main carry trade currency among international forex investors and traders. This mean it was sold by investors because its yield was so negligible, and the proceeds were invested in higher yielding currencies, such as Australian dollar (AUD) or Sterling (£). However, in the middle of the financial crisis, the yen was displaced by the US dollar, in the light of the slashed American interest rates.

Shift in lending rates

It’s now cheaper to borrow money in Yen then (more…)

Tags: carry trade, japanese currency, Yen

Published in Carry Trading, Trade forex, Yen | No Comments »

The yen strengthened beyond 100 per dollar for a second time this week as the U.S. currency’s bid to break out from a three-month low stalled after Federal Reserve minutes indicated officials were divided over the urgency to raise interest rates.

The yen strengthened beyond 100 per dollar for a second time this week as the U.S. currency’s bid to break out from a three-month low stalled after Federal Reserve minutes indicated officials were divided over the urgency to raise interest rates.

The yen rose more than 1 per cent against the dollar and the euro on Tuesday (July 26), as traders dialled back expectations of how much new stimulus Japanese authorities will inject into an ailing economy.

The yen rose more than 1 per cent against the dollar and the euro on Tuesday (July 26), as traders dialled back expectations of how much new stimulus Japanese authorities will inject into an ailing economy.