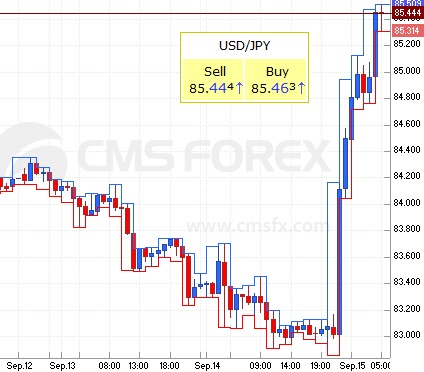

Yen strongly decreases in value after intervention

Wednesday, September 15th, 2010As we previously predicted it became inevitable for Bank of Japan (BOJ) to hold back its plans for intervention. JPY/USD went from 83 yen per dollar to 85.47 shortly after the intervention.

Strong yen – harmful for Japanese economy says Noda

Early this morning (9:30 ET) Yen reached a new 15-year high. This time, Bank of Japan was quick to intervene in the currency markets, selling yen in exchange for us dollars, after a week of possible intervention warnings. This intervention was made to counter the adverse impact of the strong yen, and was the first official intervention in the currency market since 2004.

“We conducted the intervention in order to avoid excessive movement in the currency market. The Bank of Japan will continue to (more…)